key factor for investment decisions

marginal efficiency of capital as a key factor for investment decisions

Introduction

John Maynard Keynes, one of the most influential economists of the 20th century, developed a comprehensive theory of investment and economic fluctuations. According to Keynes, investment decisions are primarily driven by the marginal efficiency of capital (MEC), which refers to the expected rate of return on an additional unit of investment. In this essay, we will explore Keynes' explanation of the MEC as a key factor in investment decisions, supported by appropriate examples

Keynes theory of investment

Keynes departed from the classical economic theory, which assumed that investment decisions are solely driven by the interest rate. Instead, he argued that the MEC plays a crucial role in investment decisions. The MEC represents the expected return on a particular investment project compared to its cost. Keynes believed that it is the subjective expectations of future profitability that drive investment, rather than the interest rate alone.

Keynesian analysis suggests that investment decisions are inherently uncertain due to the unpredictability of future events. Therefore, the MEC reflects investors' expectations about future revenues, costs, and profits associated with an investment project. Let us explore Keynes' explanation of the MEC through appropriate examples.

Example 1: Manufacturing Plant Expansion

Consider a manufacturing company contemplating the expansion of its production capacity by building a new plant. The investment decision depends on the expected profitability of the expansion project, which is evaluated using the MEC. Various factors influence the MEC, such as market conditions, technological advancements, and the company's assessment of future demand.

Suppose the company estimates that the expansion project will cost $10 million and generate an additional annual profit of $2 million. Based on these projections, the MEC can be calculated as follows:

MEC = Additional Annual Profit / Cost of Investment MEC = $2 million / $10 million MEC = 0.2 or 20%

If the company's internal rate of return (IRR) requirement is 15%, the MEC of 20% exceeds the IRR, indicating that the project is expected to be profitable. Consequently, the company would likely decide to invest in the expansion project, as the expected returns exceed the cost of investment.

Example 2: Renewable Energy Infrastructure

Consider a government considering an investment in renewable energy infrastructure, such as wind farms or solar power plants. The decision to invest in such projects involves estimating the potential returns from clean energy generation, taking into account costs, electricity prices, government incentives, and environmental considerations.

Suppose the government assesses that a wind farm project would cost $50 million and generate an estimated annual revenue of $8 million through the sale of electricity. Based on these projections, the MEC can be calculated as follows:

MEC = Additional Annual Revenue / Cost of Investment MEC = $8 million / $50 million MEC = 0.16 or 16%

In this case, if the government's required rate of return is 12%, the MEC of 16% indicates that the project is expected to be economically viable and financially beneficial. Consequently, the government would likely proceed with the investment in renewable energy infrastructure, as the expected returns justify the cost.

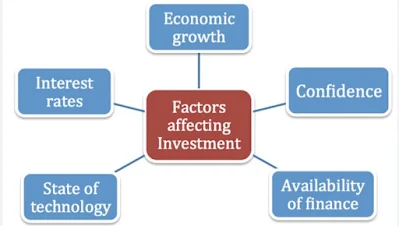

Key Factors Influencing the MEC

Keynes recognized that the MEC is influenced by several factors, including the interest rate, market expectations, business confidence, technological progress, and the state of the economy. Let us explore some of these factors in detail.

Interest Rate: While Keynes argued that the MEC is not solely determined by the interest rate, he acknowledged its influence. A higher interest rate raises the cost of investment, reducing the MEC. Conversely, a lower interest rate makes borrowing cheaper, increasing the MEC.

Market Expectations: Investor expectations about future market conditions significantly impact the MEC. Optimistic expectations of increased demand, favorable economic conditions, and profit potential can raise the MEC, encouraging investment. Conversely, pessimistic expectations can lower the MEC, leading to reduced investment.

Business Confidence: The confidence of businesses in the overall economic environment affects their assessment of the MEC. High levels of business confidence, driven by stable economic conditions, supportive government policies, and positive industry outlooks, can increase the MEC. Conversely, low business confidence due to economic uncertainty, policy changes, or market volatility can decrease the MEC.

Technological Progress: Technological advancements and innovation can have a significant impact on the MEC. New technologies can increase productivity, reduce costs, and create opportunities for higher profitability. As a result, investments in projects that incorporate new technologies often have higher MECs compared to traditional investments.

State of the Economy: The overall state of the economy plays a crucial role in determining the MEC. During economic expansions, when demand is strong and profits are high, businesses may have higher expectations of future profitability, leading to higher MECs and increased investment. Conversely, during economic downturns or recessions, when demand is weak and profits are low, businesses may have lower expectations of future profitability, leading to lower MECs and reduced investment.

Government Policies and Incentives: Government policies and incentives can influence the MEC by directly affecting the costs and returns associated with investment projects. For example, tax incentives, subsidies, or grants can lower the cost of investment and increase the MEC. Similarly, regulations promoting certain industries or technologies can enhance the profitability and attractiveness of investments in those sectors, raising the MEC.

Conclusion

Keynes' theory of investment emphasizes the significance of the marginal efficiency of capital (MEC) as a key factor in investment decisions. The MEC represents the expected rate of return on an additional unit of investment and is influenced by various factors such as market expectations, business confidence, technological progress, and the state of the economy. By considering these factors, investors can evaluate the profitability and feasibility of investment projects.

Through the examples provided, we have seen how the MEC can be calculated and used to assess investment opportunities. Whether it is a manufacturing plant expansion or an investment in renewable energy infrastructure, the MEC serves as a guide for decision-making, indicating whether the expected returns justify the costs.

Understanding the MEC and its determinants is crucial for policymakers, investors, and businesses alike. By recognizing the role of subjective expectations and the influence of various factors, stakeholders can make informed decisions that contribute to economic growth and stability.

In conclusion, Keynes' explanation of the MEC as a key factor for investment decisions sheds light on the complex nature of investment choices and provides a framework for understanding how expectations and economic conditions shape investment behavior.

Post a Comment