Nature of oligopoly || price determination under Chamberlin's duopoly model

Introduce the nature of Oligopoly. Critically explain the price determination under Chamberlin's Duopoly model.

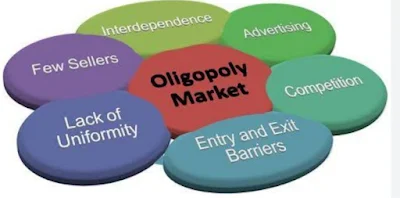

Oligopoly is a market structure characterized by a small number of large firms dominating the industry. These firms have significant market power, allowing them to influence prices and compete with each other. In this essay, we will delve into the nature of oligopoly, examining its key features, behaviors of firms, market outcomes, and the various models used to analyze oligopolistic markets.

Key Features of Oligopoly:

Few Large Firms: Oligopolistic markets are dominated by a small number of firms, often numbering between two to ten. These firms control a significant portion of the market share.

Interdependence: The actions of one firm directly impact the others in the market. Firms must consider the potential reactions of their competitors when making decisions regarding pricing, output, and product differentiation.

Barriers to Entry: Oligopolies tend to have high barriers to entry, which can include economies of scale, brand loyalty, patents, and control over essential resources. These barriers restrict the entry of new firms into the market, contributing to the dominance of existing firms.

Product Differentiation: Oligopolistic firms often engage in product differentiation to distinguish their offerings from those of competitors. This can include branding, advertising, and innovation to create unique products or services.

Behaviors of Oligopolistic Firms:

Price Leadership: In some cases, one dominant firm may set prices, and others follow suit. This can occur in industries where firms have similar cost structures and market shares.

Collusion: Firms may collude to maximize joint profits by coordinating pricing, output levels, or market shares. Collusion can take the form of explicit agreements, such as cartels, or implicit understandings through observing each other's actions.

Non-price Competition: Oligopolistic firms often compete through non-price factors, such as product quality, innovation, advertising, and customer service. This allows firms to differentiate themselves and capture market share without engaging in direct price competition.

Strategic Behavior: Firms engage in strategic behavior to gain a competitive advantage. This can include preemptive actions, retaliation against competitors, or strategic alliances to strengthen market positions.

Market Outcomes in Oligopoly:

Price Rigidity: Oligopolistic firms tend to maintain stable prices over time, even in the face of changes in demand or costs. Price rigidity can result from the desire to avoid price wars or maintain perceived market stability.

Kinked Demand Curve: The kinked demand curve model suggests that firms face a relatively elastic demand curve above the current price and a relatively inelastic demand curve below it. This asymmetry leads to price stability, as firms have little incentive to change prices unless costs significantly increase or decrease.

Excess Capacity: Oligopolistic firms often operate below full capacity to maintain flexibility and respond to changes in demand or market conditions. This excess capacity can lead to inefficiencies but allows firms to adjust production levels quickly.

Innovation and Product Development: Oligopolies tend to invest heavily in innovation and product development to maintain their competitive positions and differentiate their offerings. This can lead to technological advancements and improvements in consumer welfare.

Models Used to Analyze Oligopolistic Markets:

Cournot Model: Named after French mathematician Antoine Augustin Cournot, this model assumes that firms compete by choosing quantities of output simultaneously. Firms make output decisions based on their expectations of how competitors will respond.

Bertrand Model: Named after French economist Joseph Bertrand, this model assumes that firms compete by setting prices simultaneously. Unlike the Cournot model, firms in the Bertrand model compete directly on price rather than quantity.

Stackelberg Model: Named after German economist Heinrich von Stackelberg, this model assumes that firms compete sequentially, with one firm acting as a leader and the others as followers. The leader chooses its output or price first, taking into account the anticipated reaction of the followers.

Conclusion:

Oligopoly is a complex market structure characterized by a small number of large firms with significant market power. These firms engage in strategic behavior, interdependent decision-making, and non-price competition to maintain their competitive positions. Market outcomes in oligopoly include price rigidity, excess capacity, and a focus on innovation. Various models, such as the Cournot, Bertrand, and Stackelberg models, are used to analyze oligopolistic markets and understand the behavior of firms within them. Understanding oligopoly is essential for policymakers, regulators, and businesses seeking to navigate and compete within these markets effectively.

Chamberlin's Duopoly model is a theoretical framework that examines price determination in a market with only two firms. It builds upon the concept of monopolistic competition, where firms produce differentiated products and have some degree of market power. In this model, each firm faces a downward-sloping demand curve for its product due to product differentiation, meaning that it can influence the price by adjusting its output level.

The price determination in Chamberlin's Duopoly model revolves around the strategic interactions between the two firms, considering their interdependence and the impact of their decisions on market outcomes. Here's a critical explanation of the price determination process in Chamberlin's Duopoly model:

Demand and Marginal Revenue: Each firm faces a downward-sloping demand curve for its product. As the firms are producing differentiated products, they have some degree of market power, allowing them to set prices above marginal cost. However, since there are only two firms in the market, they must also consider the potential reactions of their competitor when setting prices.

Reaction Functions: The reaction function of each firm illustrates how its optimal output level depends on the output level chosen by its competitor. If one firm increases its output, it expects the other firm to decrease its output in response, and vice versa. These reaction functions help firms anticipate how changes in their own output will affect market prices and profits.

Nash Equilibrium: The Nash equilibrium occurs when each firm's output choice is optimal given the output choice of the other firm. At this point, neither firm has an incentive to deviate from its current strategy, as doing so would result in lower profits. In Chamberlin's Duopoly model, the Nash equilibrium represents a stable outcome where both firms are maximizing their profits given the actions of their competitor.

Price Determination: The price in Chamberlin's Duopoly model is determined by the intersection of the two firms' marginal cost curves and the demand curve for their differentiated products. Since each firm considers the potential reactions of its competitor when setting output levels, the resulting price reflects the strategic interactions between the firms.

Collusion vs. Competition: Chamberlin's Duopoly model allows for analysis of both collusive and competitive behavior. In a collusive scenario, the firms may coordinate their actions to maximize joint profits, leading to higher prices and lower output levels than under competition. On the other hand, in a competitive scenario, firms may engage in price competition, driving prices down to marginal cost levels.

In summary, price determination in Chamberlin's Duopoly model involves strategic interactions between two firms producing differentiated products. By considering the impact of their actions on market outcomes and anticipating the reactions of their competitor, firms can determine their optimal output levels and prices in pursuit of maximizing profits.

Post a Comment